An asset is something that has ascertained importance in human life. It may be due to its utility in day-to-day life or inevitability in supporting our existence. The more we use a particular thing the more it becomes valuable to us. As a result of human activity every single day we are creating assets. However, most of them are cyclical, insignificant & situational. There are only a handful few standardized known types of assets that we deal with regularly. These assets encompass almost all useful activities, commodities & services.

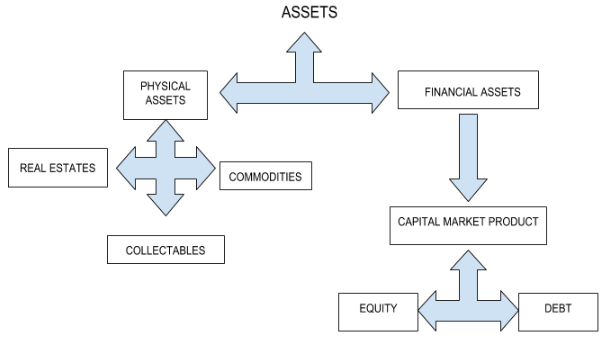

These are then classified and arranged into categories to suit the requirements or objectives. Following are the categories in which we can classify them. The image shown is restrictive in imagination. This is a globally accepted classification but one can also create a classification that meets any specific criteria or needs.

Even though there are many definitions of this term called “Asset” & then there are many websites on the internet that have different definitions some of which are ridiculous. But out of all those definitions, one that we would like to quote is mentioned here on Investopedia which defines this term – “It is as a resource with economic value. A full definition can be read on the website of Investopedia

Firstly let us look at money as an Asset, We use the money to buy things such as fruits, and vegetables & to pay salaries. We receive salaries or proceeds in the form of money when we work or sell something. We use money as a medium of exchange for almost everything we use in our day-to-day life. As a result, we can come to the conclusion that money is a vital asset. This simple example gives us conceptual clarity that what is important for our sustenance is or will become an A__et.

Types of Asset

Based on the origin there are different types of assets and all types of useful material can be classified into different categories. They are as follows.

- The property represents Land, Buildings, Construction, etc

- Commodity represents ( Anything that comes out of Earth {Land & Oceans} – be it agricultural products like cereals, oilseeds, fruits & vegetables, fisheries, metals, petroleum products, etc )

- Equity represents ( A combination of one or more Commodities )

- Bonds represent ( A contract, a promise, Loan)

- Currencies represent a mathematical expression to end the double coincidence of wants (Paper, coins, cryptocurrencies)

- Insurance represents (risk pooling nothing more )

- Art represents ( Intangible aspects like branding, abstract, personality, reputation, music, creativity, etc )

- Every financial instrument is a combination of one or more types of these base assets.

Relationship between Trading, Investment

Any type of trading or investment or exchange is only possible between different types of financial instruments. As you can see above every aspect that is near and dear to humans has been put into different categories of assets. Assets have a defined useful life cycle. Finally, when the useful life of an asset is completed, it turns into a liability. In other words, everything is in sync with nature’s cycle. Time is a universal constant. All things begin with creation, prime, and subsequently annihilation.

There are other types of classifications of assets. They are provided in the list below.

- Tangible

- Intangible

- Fixed

- Current

- Non-Current

- Operating etc

Finally, as there are many classifications, we are just going to focus only on the important ones. In other words, our base classification is sufficient to clear our doubts regarding types of assets. The other types of classification are not only utilitarian and contextual but also useless in clearing our concepts of assets in a broader sense.

So we did two things firstly we cleared doubts regarding what exactly is an asset, and secondly, we also learned how much knowledge we need to clear our concept on this topic. Once we know the source & origin of things it becomes a lot easier to co-relate one layer with the other. As can be seen in the above classification where one cannot understand the second layer without knowing the first one.

Shoutout

If you’re a new trader and would like to start your journey by learning about the stock market. Then this is an opportunity for you to join us. We will offer you complete study material for learning all the different types of financial instruments. Types of investment products, their purpose, and also how they come into existence.

The only thing we want from you is a little support. It motivates us if you share our content, give it a little appreciation or press that like button on any of the platforms. There are various ways to support us. If you’re not comfortable with publicly appreciating then you can also help us by opening your Demat account through the link provided below.